No matter the type of private fund you’re running, prospective investors must review and complete a set of confusing documents before investing in it.

As a result, funds waste hundreds of hours each year, costing them thousands of dollars in operational and compliance costs.

The manual subscription process is broken, and this article covers six ways funds can fix it with automation.

Note: if you want to fast track the implementation of an automated system for your fund, you can schedule a consultation with our document automation consultants.

1. Upgrade PDF sub docs with electronic signature

Electronic signature software might be obvious, but some funds send subscription docs to LPs as PDF attachments. However, PDFs are just a slight upgrade from paper forms as they don’t prevent errors and make automating workflows impossible. Also, emails aren’t safe for exchanging sensitive information such as SSN and bank details found in subscription documents.

I recommend DocuSign, as your investors already trust the brand.

2. Using an investor questionnaire

Electronic signature software is nice, but it’s far from great without an investor questionnaire.

Let’s say you send a subscription agreement to an investor via DocuSign. The investor wants to invest jointly but forgot to mention it to you.

Since you didn’t add their spouse in the signing workflow, your investor will need to contact and provide you with their spouse’s name and email for you to rectify the transaction.

That’s why directly sending investors a questionnaire (integrated with DocuSign) rather than a DocuSign envelope is better.

Questionnaires are great because they let investors:

- Add additional signers themselves, which means that the process can be automated as it doesn’t require any action from the fund.

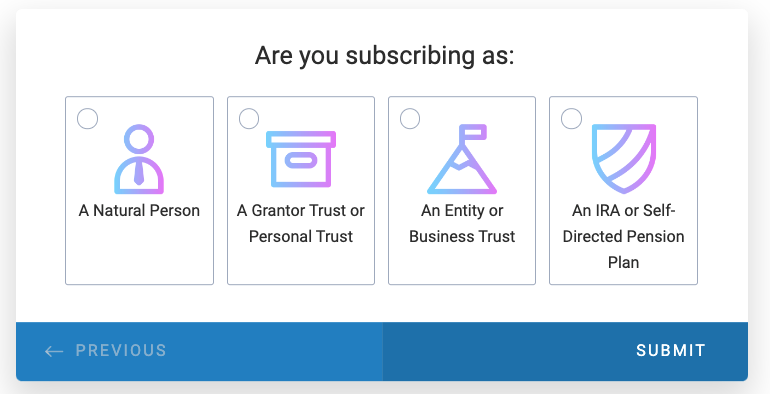

- Choose the investment vehicle that tells DocuSign which fields should be mandatory and which shouldn’t be filled out. So, for example, individual investors will not see fields for institutions.

Once the questionnaire has collected all the information needed to identify the appropriate signing flow, documents will route from one person to the next without any back and forth between the fund and the investor.

2. Add conditional rules to your forms

With standard PDFs, there’s no way to ensure all required fields are filled out correctly, which is why 90% are returned with errors.

But even if you use DocuSign, without rules adequately configured, your subscription docs will end up with missing or incorrect information. I recommend using a combination of conditional and validation rules:

Conditional rules

With conditional rules, investors only see fields they need to fill based on their investment vehicle.

Data validation rules

Data validation rules remove the risk of investors entering the wrong information in a field. For example, investors can’t enter an EIN that’s less or more than nine digits.

Electronic signature saves doesn’t just save time because it eliminates the need to print but also by ensuring the correctness of the documents.

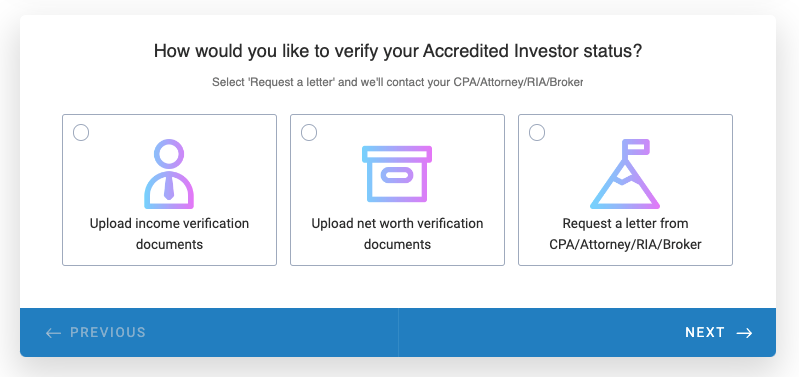

3. Automate accreditation verification

Funds typically request documents confirming the accreditation once investors have completed the subscription agreements.

But, it’s an extra step for investors and your team, which delays onboarding.

With automation, investors can request a letter from their CPA directly from the form, automatically sending a templated certification letter to their CPA to complete in a few clicks.

No manual work is needed from the investor or the fund.

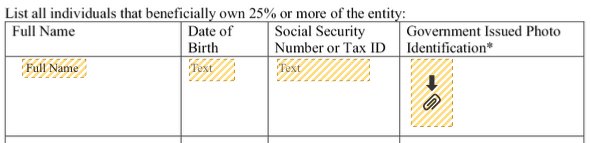

3. Automate capture of IDs and other documents

With eSignature, ‘attachment’ fields can be added to subscription documents to allow investors to upload files securely.

5. Automate wiring instructions

Typically, funds manually email wire details to investors once the General Partner has signed the subscription documents.

This email can be fully automated when using electronic signature software.

6. Hire experts to automate your onboarding workflow

While automating onboarding processes is very rewarding and saves a ton of time for everyone, it can be a monumental task, given all the moving parts that need to be integrated.

Hiring a consulting firm can help you ensure the implementation is successful. For example, Solusign Consulting has been helping funds automate investor onboarding workflows since 2019.

Contact us at [email protected] for more information or book a call here or read one of the below case studies to understand how we helped tens of funds automate investor onboarding.

Case study: How this $800M real estate fund automates investor subscriptions